Last Updated on | Published: June 6, 2023 |

Yay! I got my first job after graduation! But what are ESPP and RSU?

Employee Stock Purchase Plan (ESPP)

- ESPP allows an employee to buy the company stock at a discounted price with part of the employee’s salary.

- The discount and the maximum percentage of the salary for employee stock vary from company to company, usually 5-15%

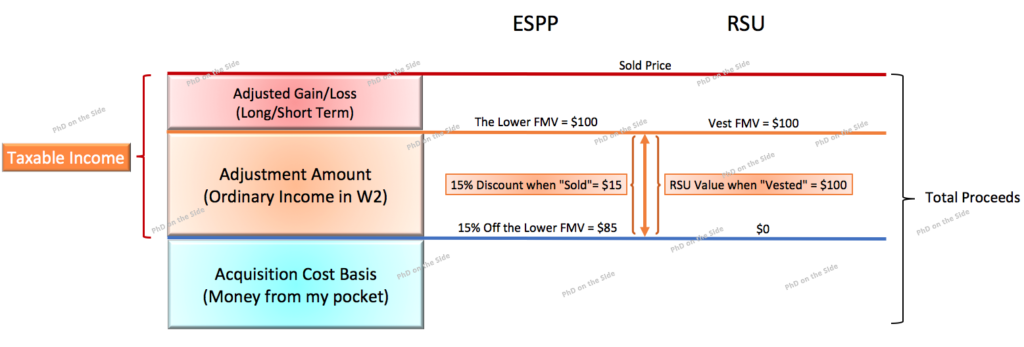

- During the ESPP offering period, there will be 2 fair market values (FMV). One is on the first day of the ESPP offering period called “Grant Date FMV”. The other is on the last day of the period called “Purchase Date FMV”. The lower FMV and the ESPP discount percentage will determine your “Acquisition Cost Basis”.

- Tax occurs only when your ESPP stock is “sold” and the ESPP discount amount will be added to “Taxable Wages” as “Ordinary Income” in your W2 the year when you sold your ESPP stock.

- Be aware to adjust your gain/loss when filing taxes with the discount amount already in W2 to avoid double taxation! Always check “Supplemental Information” from your brokerage firm and W2 to file “Adjusted Gain/Loss” correctly.

ESPP Example:

Let’s assume the discount is 15% off and the ESPP offering period is from February 1st to July 31th.

The Grant Date FMV on Feb 1st is $100 per share. The Purchase Date FMV on July 31th is $110 per share. Thus, the lower FMV is $100.

ESPP Discount = Ordinary Income in W2 = Discount% x the Lower FMV = 15% x $100 = $15 per share

Acquisition Cost Basis = (100% – Discount%) x the Lower FMV = (100%-15%) x $100 = $85 per share

Adjusted Gain/Loss = Total Proceeds – ESPP Discount – Acquisition Cost Basis

- If you sold the stock at $120 per share, “Adjusted Gain” = $120 – $15 – $85 = $20 per share

- If you sold the stock at $85 per share, “Adjusted Loss” = $85 – $15 – $85 = -$15 per share

It means you lost all your 15% discount benefit because this cancels out the $15 per share filed in your W2 🙁

Restricted Stock Unit (RSU)

- RSU is a reward a company gives an employee usually based on the annual performance. The vest periods can be quarterly or annually.

- Tax first occurs when your RSU is “vested” as Ordinary Income in W2. But Adjusted Gain/Loss occurs when you sell it.

- Because of IRS regulations, brokerage firms have to report RSU Acquisition Cost Basis as ZERO! However, the real cost basis is the “vested” value of RSU, added to your W2 as “Ordinary Income”.

- Usually the RSU tax payment type is “Withhold Shares”. Federal and State Withholdings for RSU will show up in W2, respectively.

- Again, to avoid double taxation, always check “Supplemental Information” from your brokerage firm and W2 to file “Adjusted Gain/Loss” correctly.

RSU Example:

You are invested with 13 shares of RSU at $10 per share by your company.

You ended up getting only 10 shares of RSU in your brokerage account because the 3 shares are “Withhold Shares” for the equivalent cost (3 x $10 = $30) of Fed/State/other taxes.

Acquisition Cost Basis = Total Proceeds – RSU Vested Value in W2 – Acquisition Cost Basis

RSU adjusted amount = Vested RSU AFTER Tax in W2 = 10 x $10 = $100

- If you sold the 10 shares of RSU at $12 per share, “Adjusted Gain” = 10 x ($12 – $10 – $0) = $20

- If you sold the 10 shares of RSU at $9 per share, “Adjusted Loss” = 10 x ($9 – $10 – $0) = -$10

It means you only got $90 from your RSU (=$100 – $10) 🙁

Summary

- ESPP tax occurs only when you “sell” the stock. RSU tax first occurs in W2 when it’s “vested“, while Adjusted Gain/Loss will depend on when you sell your RSU.

- What’s reported in your W2? ESPP discount amount and RSU vested value, respectively. Avoid double taxation when you do your tax return!

- Always check “Supplemental Information” from your brokerage firm and W2 to file “Adjusted Gain/Loss” correctly.

I found a lot of people just keep their ESPP/RSU stock without realizing the company stock price is dropping to the extent of eating away the ESPP discount or RSU vested value. What a waste!

If you think your company ESPP/RSU are worth keeping, I’d strongly recommend you keep track of ESPP/RSU adjusted cost basis and examine the portion of your company stock in your portfolio carefully. Can you tolerate the risk?

I personally prefer not to have any individual stocks and would like to invest the free money from working hard somewhere else for the long term. Read more: “From Negative to Fire: Asset Allocation Formula”