Last Updated on | Published: January 17, 2024 |

We know that Fidelity offers cash management accounts with a debit card that allows you to withdraw money in local currency from any ATM overseas and reimburse you with the ATM fee. However, there might be a mark-up fee if you do it wrong on an ATM!

What’s a Mark-up fee or Conversion Fee?

It is a fee that charges you for converting the local currency into USD. Basically banks make money by tricking people using conversion when they shop with a credit card or withdraw money from the local ATMs.

Many places in Japan accept US credit cards, especially big cities like Tokyo and Osaka. However, some local small stores or restaurants, such as Ramen, only accept cash. So I usually withdraw ¥10,000 at the airport every time I go to Japan for a trip just in case. If I didn’t use up the cash, I could always deposit it to my Suica, an IC card for taking trains or shopping.

ATM Withdrawal in Japan Correctly Step-by-Step!

The example here was in Narita international airport. Once you arrive, look on your left, you will see Visitor Service Center.

You should see the sign of ATM as soon as you approach the entrance of the Visitor Service Center. Turn left again, there are many ATMs right next to the escalator. I picked the 7-Eleven ATM.

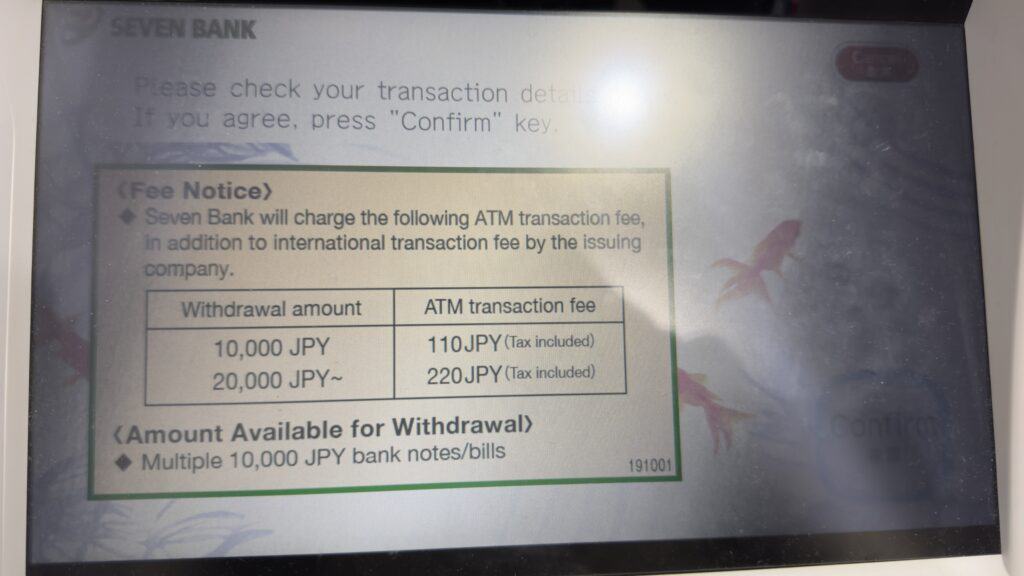

First, the fee notice will tell you how much fee is required for the amount of money you withdraw. If you withdraw ¥10,000, the ATM fee is ¥100. However, if you want to withdraw above ¥20,000, the ATM fee is ¥220.

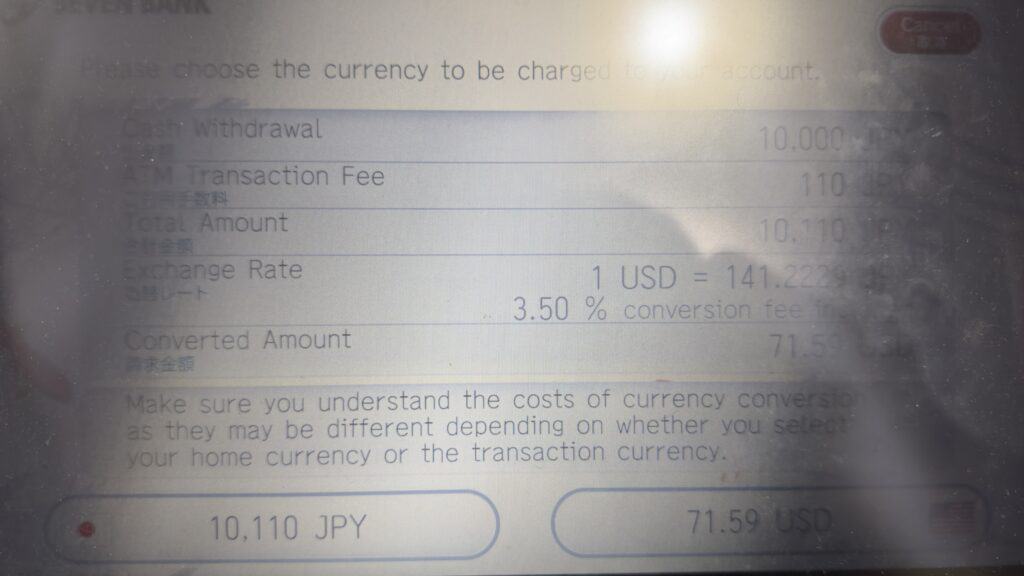

Now here’s the tricky part: choose the currency. The screen is not dirty or of low quality but to prevent others from peeking your debit card information from the side or from your back. As you can see, it shows the exchange rate at the time and 3.5% conversion fee, which gives the converted amount 71.59 USD on the screen.

Hold your urge to press the USD option. Choose the Japanese yen option instead!

Let me show you the difference side-by-side. On the left, it was the withdrawal in 2022. On the right, it was in 2023.

If you choose USD, you will pay for the conversion fee 3.5%. If you choose Japanese yen, there’s no conversion fee!

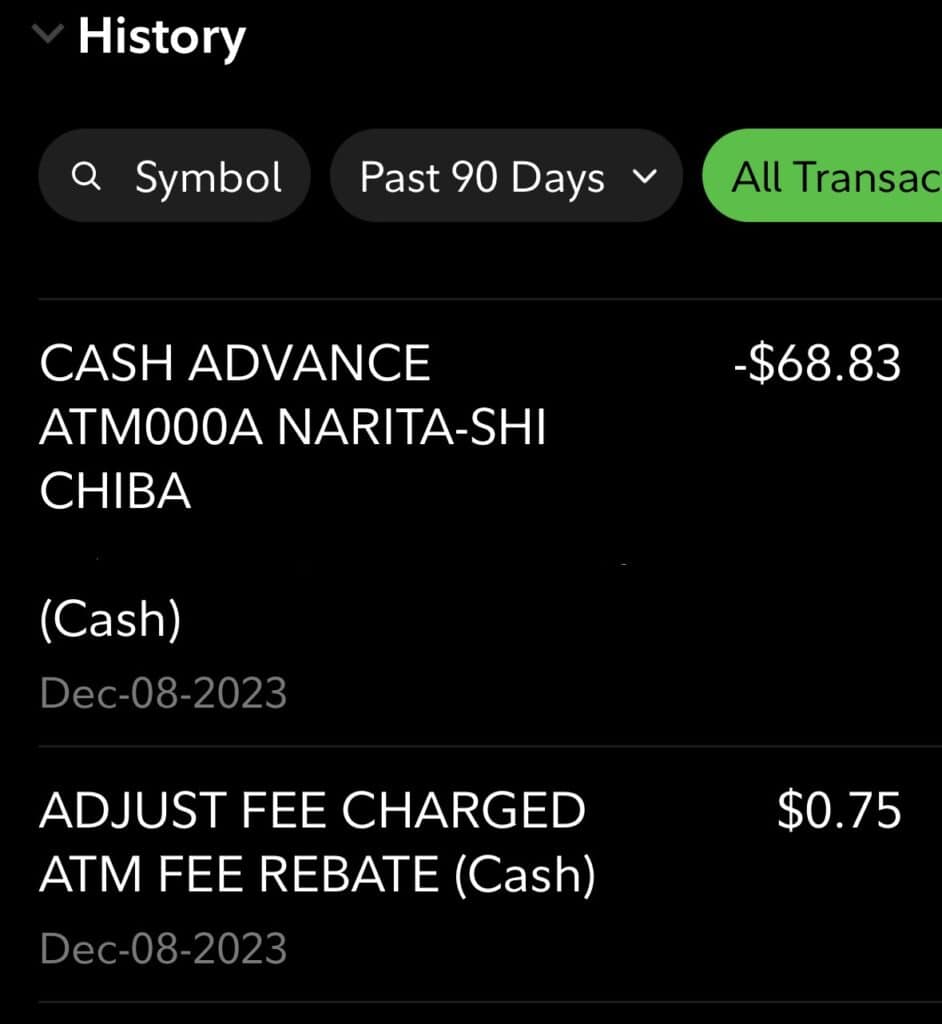

Let’s also look at Fidelity transaction history to double check. Only $68.83 was withdrawn for ¥10,000 and I got reimbursed with $0.75 for ATM fee, ¥100. It usually takes a couple days for the reimbursement posted to your account.

For this amount of money, the conversion fee is small, but if you need to withdraw a lot of cash, then it will make a difference.

I believe it also applies to credit cards without foreign transaction fee. I was asked several times by cashiers to choose the currency before it went through the transaction on my credit card. I did not know the difference… I just don’t like the sly trick from local banks to steal my money.

ATM Withdrawal in Taiwan

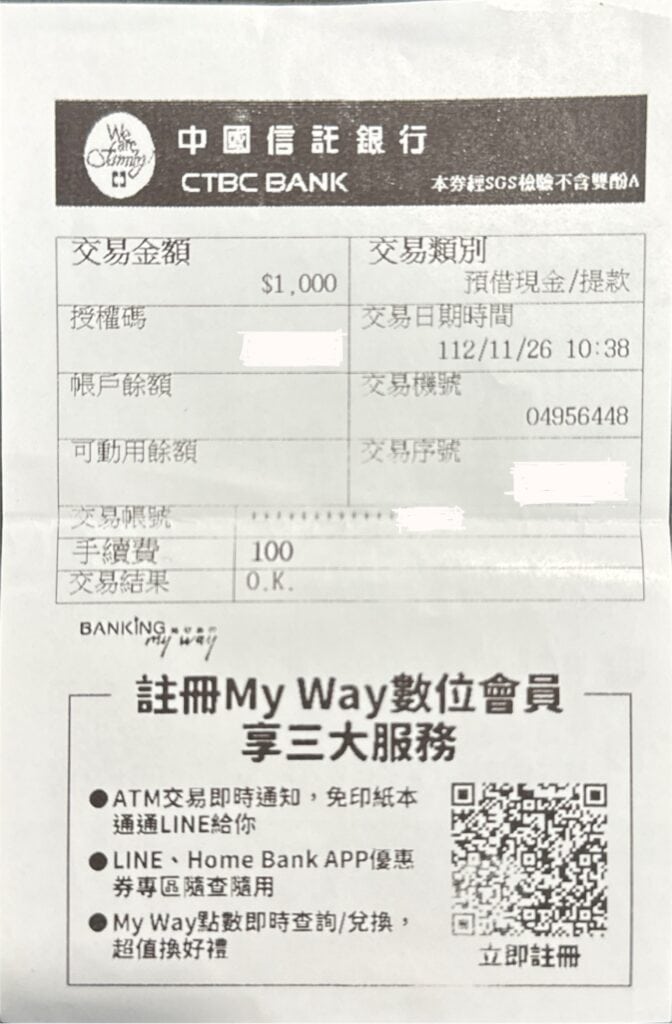

Choose China Trust ATM at any 7-Elevens in Taiwan and there’s no tricky selection on the screen! No matter how much you withdraw, the ATM fee is flat at NTD100. I was also reimbursed by Fidelity with $3.16, equivalent to NTD100 at that time.

Other ATMs may trick you into a 4-5% mark-up fee if you do not choose “delay conversion” or whatever terms that are similar.

The density of convenience stores in Taiwan is the highest in the world. It’s very easy to find a 7-Eleven in Taiwan. Probably every one or two blocks.

Summary

- Get a ATM debit card that can reimburse you ATM fee worldwide, such as Fidelity and Charles Schwab

- Universal rule: Always choose “local currency” or “delay conversion” to avoid conversion fee or mark-up fee. This also applies to credit cards.

- I’ve only tested 7-Eleven ATMs in Japan and Taiwan. You’re welcome to comment and share your experience with a different ATM or in a different country outside the US.

This is my first time pay a quick visit at here and i am truly pleassant to read all at alone place.