Last Updated on | Published: February 4, 2023 |

Dream of retiring early? Know nothing about investment? No worries. A PhD may not be financially smarter than you!

Negative

I grew up in an ordinary Taiwanese family. My parents have been very frugal. I have been taught to study well and I did.

The only thing about personal finance I’ve known since I was little was to save my red-envelope money from relatives every Lunar New Year.

Investment? Sounds like a term only for business and the rich. Instead, I was warned not to “PLAY” stocks because it’s dangerous and you will lose all the money. Judging from the word “PLAY”, you can clearly see that the older generation of Taiwanese considers the stock market as gambling.

The “negative” feelings about stock markets had been rooted in me until I started to work in the US.

ZERO – Seed of FIRE

I bumped into the blog of GoCurryCracker! during my PhD. I instantly knew “Financially Independent & Retire Early” is what I want to pursue, but I had no idea of how to achieve it. At the same time, I also felt funny that I was thinking about “Retire Early” without even starting a real job out of school. As a poor PhD student, I just set aside the thought of FIRE and focused on the research.

The Trigger

The stock market crashed in March 2020 due to COVID-19. Even though I knew nothing about the stock markets, apparently it was a good time to buy the dip. All I knew was saving so I had a quite amount of idle cash.

However, it’s scary if I don’t know what I’m doing just for the sake of buying. I started to read books about FIRE and research everything I could until I felt comfortable with the investment mindset. From the 4% rule, index funds/ETFs, bonds, asset allocation, taxes to Roth conversion ladder, it’s a whole new world! (Aladdin music in the background 🙂 )

Start of FIRE

My FIRE strategy is boring. Buy and hold passive index funds/ETFs for the long term because 90% of the actively managed funds failed to beat the market.

It’s all about human nature. The best investment is what makes you sleep well at night.

I feel more comfortable about stock market indices, such as the total US market and S&P 500, because they are diversified and the fluctuations are smaller compared with individual stocks. When the passive indices fall, everyone falls too. Mentally, it also makes me feel better. Besides, like what JL Collins said in “The Simple Path to Wealth”, index funds/ETFs also automatically self-clean their compositions by getting rid of the companies that are no longer competitive. In the long term, the stock market always goes up.

My Asset Allocation Formula

Why do you need an asset allocation?

Setting rules and boundaries for your assets is important for your sanity. Tracking your asset allocation will help you to examine your risk tolerance and stay in the course of your investment strategies. It is likely to reduce unnecessary panicking sales or overbuying.

How to set up your asset allocation? Here are the things to consider:

Emergency funds

People usually talk about 3-6 months of emergency funds, but I think it’s too risky. What if I lose my job and the job market is bad? I’d prefer at least 1 year of living expenses instead.

Money to buy the dip

Seeing the stock market crash in March 2020, I missed that opportunity. Again, I set aside at least 1 year of living expenses just in case.

Equity: Bond/Cash = 70: 30

There’s a classic stock allocation rule by age. The older you are, the lower risk of a portfolio to pursue. For example, if you are at 30, 70% (100% – 30%) would be your equity allocation. If you are at 60, you should reduce your equity to 40%. However, is it still applicable to date?

I agree that we should reduce the risk of our portfolios as we get older. But the life expectancy is getting longer than that in the old times. Some even suggest 100% stocks if you are in your 20’s or 30’s. It’s really about your risk tolerance.

Equity Ratio – Domestic (US): Foreign = 80: 20

Here comes the tricky part.

Global diversification is important but too much of foreign equity may not help your portfolio performance much. According to Statista, stock markets in the US accounted for 60% of the world stocks in 2022. VEA (Vanguard FTSE Devlpd Mkts ETF) and VXUS (Vanguard Total Intl Stock Idx ETF) both have a high correlation of 0.86 with VTI (Vanguard Total Stock Market Index Fund ETF). Even VWO (Vanguard FTSE Emerging Markets ETF) also has a high correlation of 0.72. JL Collins of “The Simple Path to Wealth” even suggests 0% of foreign equity because many companies in the US are already international businesses.

People always have home country biases. I still prefer a certain degree of global diversification so my taxable portfolio is mainly VTI and VEA.

No emerging markets?

S&P 500 was the worst market in the “Lost Decade” 2000 – 2009 with a negative annualized return at -0.95%. However, S&P 500 came back strong in 2010-2019 with an annualized return at 13.56% outperforming other international markets. If we look at the span of 2000-2019 together, the annualized returns of S&P 500 and emerging markets are 6.06% and 7.7%, respectively. It turned out to be similar for the long term.

VWO now is heavily weighted on China (37.4%) and Taiwan (17%). As a Taiwanese, I know well the tension between Taiwan and China. China’s crackdown on Alibaba and Ant Group further alerted that political power is way above its market.

No individual stocks

A high percentage of individual stocks will ruin the goal of my diversified portfolio.

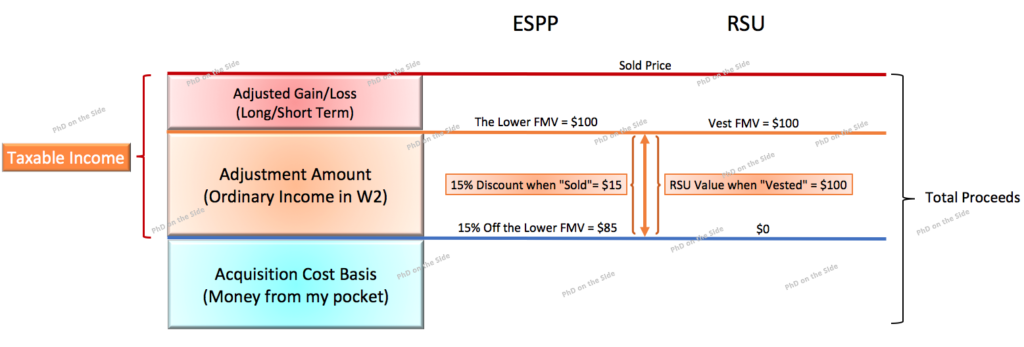

How about ESPP and RSU? If your employer can fly to the moon, holding them may be good. If not, it would be risky to put all the eggs in the same basket. In the case of a huge layoff, a company stock is likely to slide on top of losing your stable salary income. If you want to keep a certain percentage of employer stocks, another strategy is to sell some ESPP when you get RSU.

My FIRE Numbers

4% rule

What’s the 4% rule?

The 4% rule was derived from the Trinity Study. If you withdraw only 4% of your initial portfolio in the first year, and in the subsequent years you withdraw 4% with inflation adjusted, you should have a high probability to live on your initial total assets for 30 years.

That’s why the rule of thumb for FIRE is the 4% rule, meaning total asset worth is 25 times of annual expense. This is the minimum FIRE requirement. However, a lot of other things to consider beyond the Trinity Study, such as taxes, time span and portfolio composition. Schwab’s suggested initial withdrawal rates for a “moderate” portfolio are 3.4% – 4.1% based on 2022 10-year long-term return estimates.

At least 80% in Taxable Accounts

Because withdrawing from retirement accounts prior to age 59.5 triggers a 10% penalty, maxing out annual contributions to 401K or IRA may not be a good idea for early retirees.

Summary

Personal finance is not taught at school. Constant self-learning is always the key. Learning about myself in the process is equally important. Asset allocation is the foundation but not set in stone. Adjust your portfolio to your comfort zone so that you can sleep well at night!

Although I create myself an allocation formula, sometimes the devil of greed can distract you… I know 90% of the actively managed funds failed to beat the market. But I still learned it the hard way. My biggest mistake was ARKK…

Disclaimer: This post is purely to share my observation and opinion. This is not meant for investment advice. You are responsible for your own decision making.

References:

- Stock Allocation Rules

- Countries with largest stock markets globally 2022

- ETF Correlations with VTI

- A Tale of Two Decades: Lessons for Long-Term Investors

- Ant, Alibaba plan for less intertwined future after China crackdown

- Beyond the 4% Rule: How Much Can You Spend in Retirement?

- Most investment pros can’t beat the stock market, so why do everyday investors think they can win?